Half Year 2025

Financial Highlights

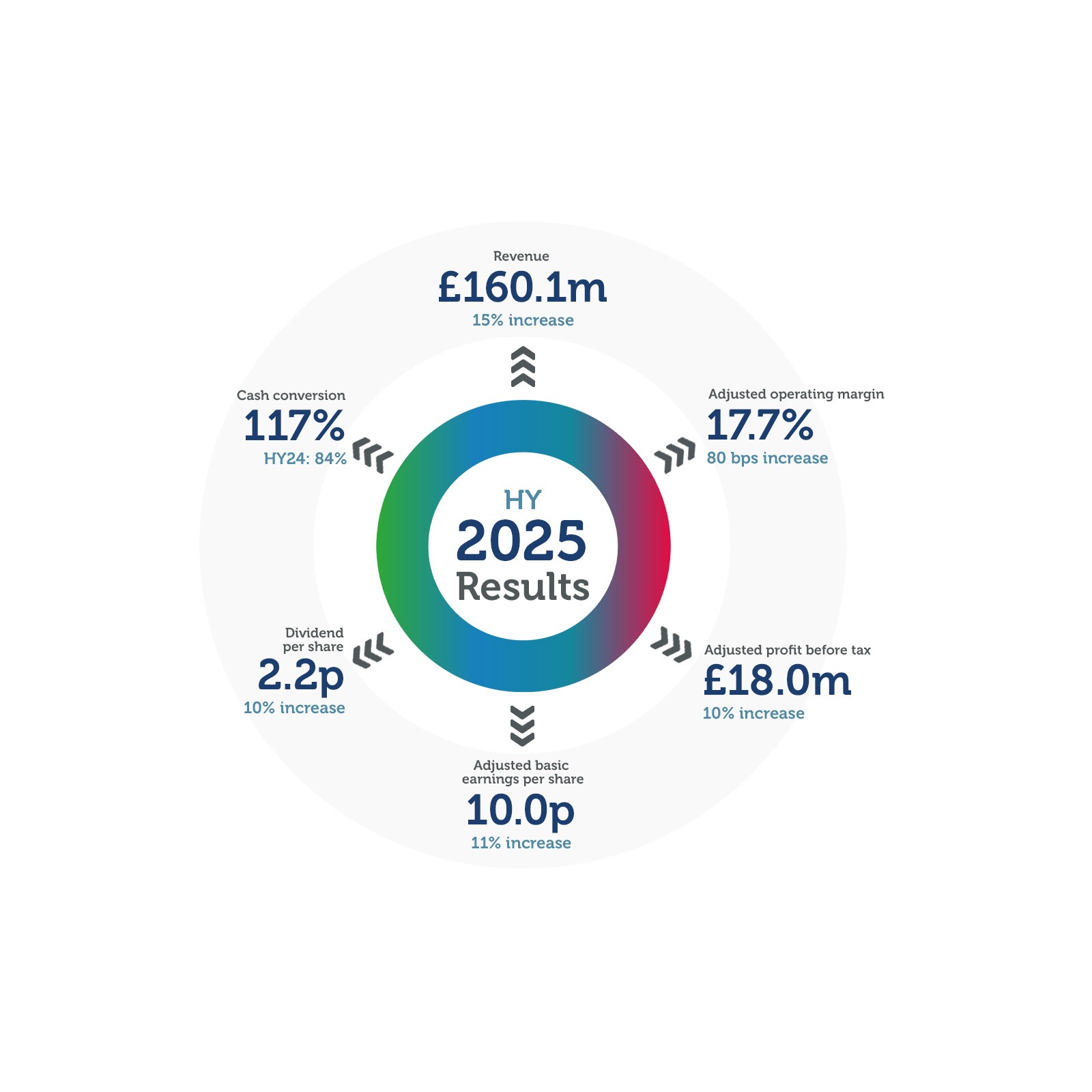

Our group revenue reached £160.1 million, marking a 15% increase, driven largely by recent acquisitions. We continue to benefit from a strong base of recurring storage income in its Information Management division, supporting stable overall revenue.

- Adjusted operating margin improved by 80 bps to 17.7%, up from 16.9% in the first half of 2024. This improvement reflects ongoing actions to boost profitability and advances the company toward its medium-term target of a 20% margin.

- Adjusted profit before tax climbed 10% to £18.0 million (H1 2024: £16.3 million), while adjusted basic earnings per share rose by 11% to 10.0p (H1 2024: 9.0p). Free cash flow also improved to £22.3 million, (£14.9 million in 2023), with cash conversion of 117% (H1 2024: 84%).

- Reflecting confidence in our outlook, Restore plc declared an interim dividend of 2.2 pence per share, representing a 10% increase.